Lifetime Brands Inc (LCUT) Q1 2024 Earnings: Misses Revenue Estimates and Reports Increased Net Loss

Revenue: Reported at $142.2 million, falling short of estimates of $144.94 million.

Net Loss: Reported at $6.3 million, worse than the estimated net loss of $3.11 million.

Earnings Per Share (EPS): Reported at -$0.29, worse than the estimated EPS of -$0.14.

Gross Margin: Increased to 40.5% from 37.0% in the previous year, indicating improved profitability per dollar of sales.

Income from Operations: Improved to $1.8 million, recovering from a loss of $1.8 million in the prior year.

Liquidity: Remained strong with $125.1 million available, ensuring financial flexibility for future investments.

Full Year Guidance: Projected net sales for 2024 between $690 million and $730 million, with adjusted net income expected to be between $15 million and $17 million.

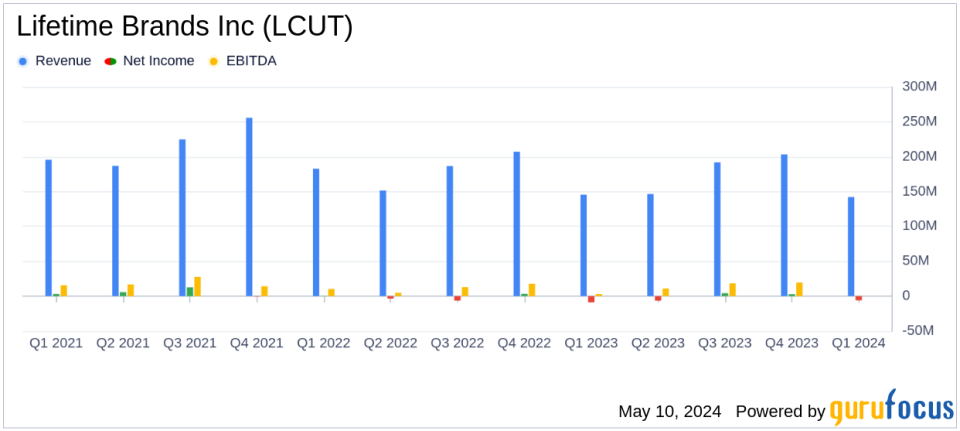

Lifetime Brands Inc (NASDAQ:LCUT), a prominent global designer, developer, and marketer of a wide range of consumer products for the home, disclosed its financial results for the first quarter ended March 31, 2024. The company's detailed financial performance was revealed in its 8-K filing on May 9, 2024.

Company Overview

Lifetime Brands Inc is based in the U.S. and operates primarily in the kitchenware, tableware, and other domestic product sectors. The company markets its products under various brands including Farberware, KitchenAid, and Mikasa, among others. Products range from kitchen tools and gadgets to cutlery, dinnerware, and glassware. Lifetime Brands primarily serves its markets through wholesale to retailers and also directly to consumers via brands like Pfaltzgraff and Mikasa. The U.S. segment is the major revenue contributor.

Q1 Financial Performance

The company reported consolidated net sales of $142.2 million for Q1 2024, a decrease of 2.2% from $145.4 million in the same period last year. This figure fell short of analyst expectations which projected revenues of $144.94 million. The gross margin improved significantly to 40.5% compared to 37.0% in Q1 2023, reflecting favorable product mix and stable supply chain conditions.

Despite the improved gross margin, Lifetime Brands experienced a net loss of $6.3 million, or $0.29 per diluted share, compared to a net loss of $8.8 million, or $0.41 per diluted share, in the prior year's quarter. The adjusted net loss was slightly reduced to $3.2 million, or $0.15 per diluted share, from an adjusted net loss of $2.6 million, or $0.12 per diluted share, year-over-year.

Operational Highlights and Challenges

Rob Kay, CEO of Lifetime Brands, expressed satisfaction with the quarter's performance, highlighting strong sell-through rates despite economic pressures and inventory adjustments by retailers. The company's strategic initiatives aimed at margin expansion and disciplined expense management contributed positively to the financial outcomes. However, the overall net sales decrease and higher net loss underline ongoing challenges in market conditions and consumer spending behaviors.

Financial Position and Outlook

Lifetime Brands reported a robust liquidity position with $125.1 million as of March 31, 2024, ensuring ample financial flexibility for future investments. Looking forward, the company provided a full-year 2024 guidance anticipating net sales between $690 million and $730 million, and adjusted net income between $15 million and $17 million, projecting diluted earnings per share in the range of $0.69 to $0.78.

Analysis

The first quarter results reflect a mixed financial performance by Lifetime Brands. While the company has successfully improved its gross margin and reduced its adjusted net loss, the decrease in net sales and a higher overall net loss compared to analyst expectations indicate potential volatility and challenges ahead. The forward guidance suggests a cautiously optimistic outlook, banking on strategic growth initiatives and market opportunities.

Investors and stakeholders will likely keep a close watch on the company's ability to navigate market fluctuations and realize its projected growth in the increasingly competitive home products market.

Conclusion

As Lifetime Brands continues to adapt and strategize in a challenging economic environment, the company's focus on operational excellence and strategic growth initiatives will be crucial in driving future profitability and shareholder value.

Explore the complete 8-K earnings release (here) from Lifetime Brands Inc for further details.

This article first appeared on GuruFocus.